In the context of the global health crisis caused by the expansion of COVID-19, the Korean economy is facing an unprecedented crisis, as are many countries around the world. The Korean government's response to this challenge has been to resort to fiscal and monetary policies, use reserve funds and the supplementary budget to prepare economic policies worth more than 50 trillion won, with aid for the population.

Korea's economic policy against COVID-19 can be summarized in the three financial support packages approved and the reduction of the base rate by the Central Bank of Korea. In addition, the government has raised the limits on foreign exchange trade, managing the exchange rate and adopting an "emergency disaster grant".

Thus, the first financial stimulus package remained in place from 5 to 12 February. The Korean government prepared several emergency support measures totalling 4 trillion won through the 2nd to 4th Ministerial Meeting on Boosting the Economy.

The second comprehensive support package against the coronavirus was announced on February 28, with a total of 20 trillion won in additional support:

- 4 billion won, including government reserve funds and policy funding to support disease prevention, local governments, imports of manufacturing supplies and small traders

- 7 billion won to provide financial and fiscal support to affected families and businesses, including a 50 percent income tax cut given to landlords for rent reduction and cuts in individual consumption tax for car purchases to boost consumption.

- 9 billion won of loans, guarantees and investments through financial institutions and public institutions

- Supplementary budget to support local economies, as well as disease control

This second package was extended on 16 March with the decision to lower the base rate. In effect, the Bank of Korea's Monetary Policy Board decided to reduce the base rate by 50 basis points, from 1.25% to 0.75%, as of March 17. In a series of related actions, the Board has decided to reduce the interest rate of the Intermediate Bank Loan Support Facility from 0.50%-0.75% to 0.25%, as from the same date. In order to manage financial market liquidity at a sufficient level, the Board will also extend the guarantees eligible for open market operations to include bonds issued by banking institutions.

At the same time, although Korean banks have maintained a relatively high level of foreign exchange liquidity, Korea intends to be prepared for sudden volatility in the foreign exchange market. The government has decided to raise the limit on foreign exchange futures trading by 25 percent, to 50 percent for local banks and 250 percent for branches of foreign banks, as of March 19.

The draft amendment to the Excise Tax Restriction Law to support the ailing business sector was presented to the National Assembly on 17 March. Among other measures, it includes: special tax reductions or exemptions for SMEs and small businesses, under certain conditions; tax benefits (estimated to total more than KRW 340 billion); exemption of taxable persons from VAT payment obligations and VAT relief for individual entrepreneurs with sales of KRW 40 million or less in each 6-month VAT period, etc.

As part of the third financial stimulus package, the government announced a financial support package worth more than 50 trillion won on March 19 to help businesses and households affected by the COVID-19 outbreak. The package consists of programs designed to help sustain businesses, ease the burden on borrowers and avoid a credit crisis.

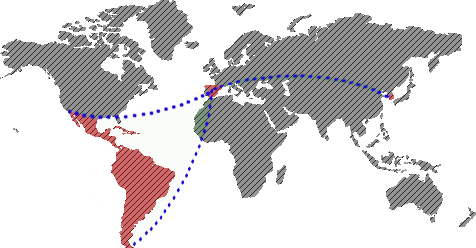

Similarly, the Bank of Korea and the Federal Reserve will establish a temporary bilateral foreign exchange agreement (swap line) to provide liquidity in United States dollars. This new line will support the provision of liquidity in United States dollars up to $60 billion in exchange for the Korean won, and will be in effect for at least six months. This facility is designed to help ease tensions in the United States dollar funding markets, thereby mitigating the effects of those tensions on the supply of credit to households and businesses.

On March 26, new decisions were taken: the government has decided to relax the stability rules of the country's foreign exchange market, as uncertainty in capital flows continues to grow amid fears about the spread of COVID-19. These rules were first introduced after the 2008 global financial crisis to control excessive capital movements and short-term borrowing, and have since been applied flexibly in line with changes in market conditions.

On the same date, the Bank of Korea (BOK) decided to provide unlimited liquidity to financial institutions as part of its efforts to combat the coronavirus pandemic. The BOK committed to buying the full amount of the repurchase agreements (also known as PR) without limit on a regular basis every week until the end of June. The interest rate was set at 0.85 percent as a ceiling, which is an increase of 0.1 percentage points per year in the reference rate (0.75 percent per year). However, it differs from the Quantitative Easing (QE) implemented by several countries such as the United States, in that the Central Bank of Korea has not yet introduced its direct purchase of corporate bonds or CPs. The extent of this Korean version of QE will be determined after July, taking into account market conditions.

The following two measures, together with the increase in currency futures trading limits announced on March 18, will contribute to the stability of the foreign exchange market:

- the taxation of non-deposit foreign exchange liabilities to financial institutions will be limited during the next three months from April to June. Installment payments will be applied and extended for liabilities, which were imposed last year and are expected to be collected this year;

- low foreign exchange liquidity coverage ratio (LCR) of 70 percent, below 80 percent, for a limited period until May, to be applied as soon as approved by the Financial Services Commission.

The Korean Government decided during the third crisis management meeting on 30 March that it would provide an emergency relief payment to households with income levels that fall into the lower 70 percent (households with income at or below 30 percent above - 70 percent). The provision of this subsidy will be made to families in the form of a certificate worth one million won based on a family of four, the level of which will be modified according to the number of family members. Emergency payments will total 9.1 trillion won, and this measure is expected to be approved by the National Assembly in April after the second supplementary budget is implemented.

The Korean government has submitted supplementary budget plans to address the economic impact of the COVID-19 outbreak in the following areas as well:

- for the support of tariff reductions on emergency air transport in connection with COVID-19;

- an amendment for special employment support for tourism and performance industries;

- support for the Ministry of the Interior's infrastructure for callcentres;

- the emergency support plan for the aviation sector;

- emergency financial support measures for shipping companies on routes between Korea and China;

- simplification of the administrative procedure for chemicals during COVID-19 and local fiscal support for COVID-19.